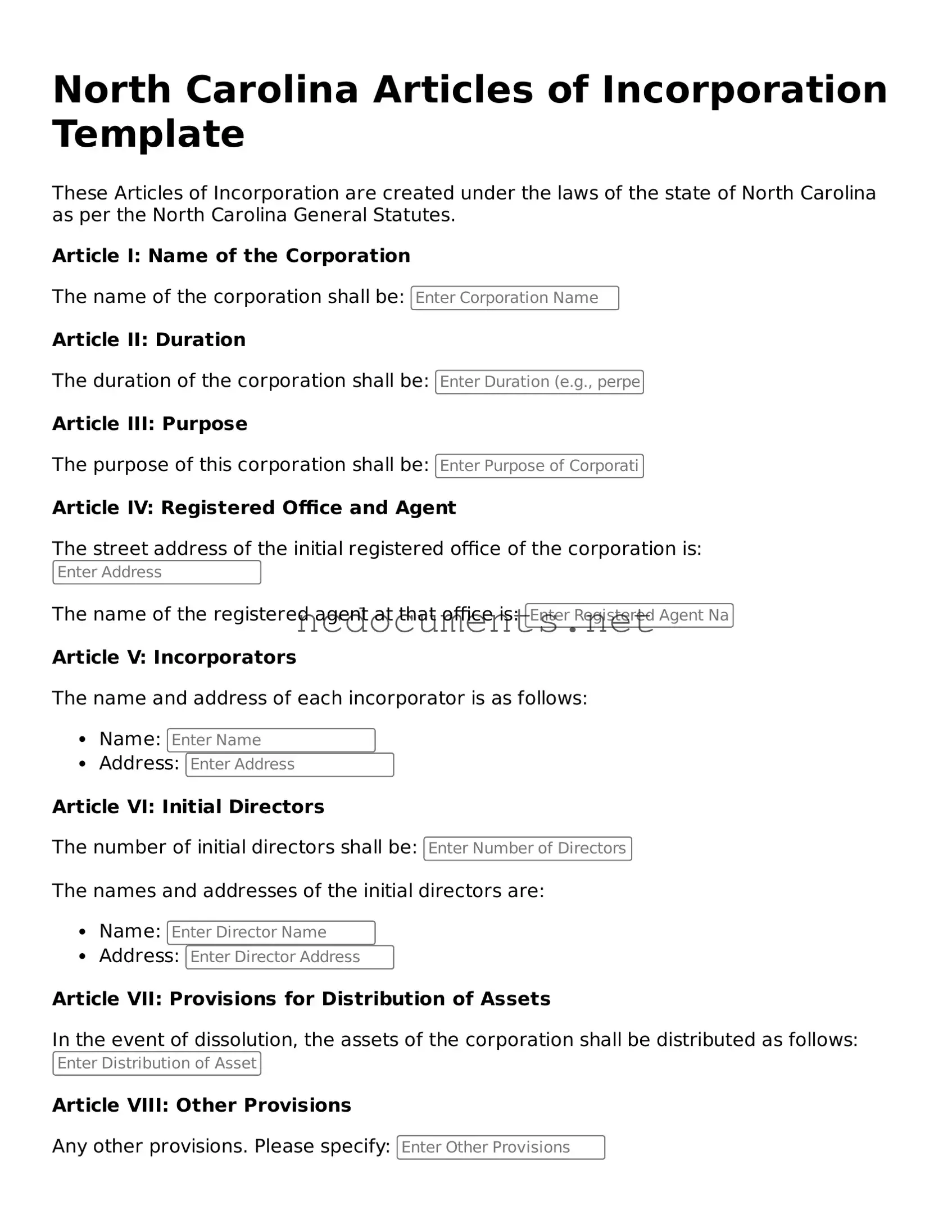

The North Carolina Articles of Incorporation form shares similarities with the Certificate of Incorporation, commonly used in other states. Like the Articles of Incorporation, this certificate serves as the foundational document for establishing a corporation. It typically includes essential information such as the corporation's name, purpose, registered agent, and the number of shares authorized. Both documents are filed with the state’s Secretary of State office, marking the official creation of the business entity. The primary difference often lies in the specific state requirements and terminology, but the overall function remains consistent across jurisdictions.

When engaging in the sale of all-terrain vehicles, it's vital to utilize the appropriate documentation to ensure a clear transfer of ownership. The All Colorado Documents provide an essential resource for creating a Colorado ATV Bill of Sale, which serves as a critical legal instrument to confirm the sale and protect both buyers and sellers during the transaction process.

Another document closely related to the Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation establish the corporation's existence, the Bylaws outline the internal rules and regulations governing the corporation's operations. These rules cover aspects such as the management structure, the duties of officers and directors, and the procedures for holding meetings. Both documents are crucial for a corporation's governance, but they serve different purposes: one is about formation, while the other addresses operational guidelines.

The Limited Liability Company (LLC) Articles of Organization is another document that bears resemblance to the Articles of Incorporation. Both documents are used to officially create a business entity, but the LLC Articles of Organization are specifically for forming a limited liability company. Like the Articles of Incorporation, this document includes the name of the business, the address, and the registered agent. The key difference is that an LLC offers different tax benefits and legal protections compared to a corporation, yet both documents serve to establish a separate legal entity.

The Partnership Agreement also has similarities with the Articles of Incorporation, particularly in how it formalizes a business arrangement. While the Articles create a corporation, the Partnership Agreement establishes the terms and conditions of a partnership. This document outlines the roles, responsibilities, and profit-sharing arrangements among partners. Both documents aim to provide clarity and structure to business relationships, ensuring that all parties understand their rights and obligations. However, they cater to different business structures, with partnerships being less formal than corporations.

Lastly, the Certificate of Good Standing is another document that complements the Articles of Incorporation. Once a corporation is established, the Certificate of Good Standing serves as proof that the corporation is legally registered and compliant with state regulations. This document is often required for various business activities, such as securing loans or entering contracts. While the Articles of Incorporation initiate the corporation's existence, the Certificate of Good Standing confirms its ongoing compliance, making both documents essential for maintaining a business's legal status.