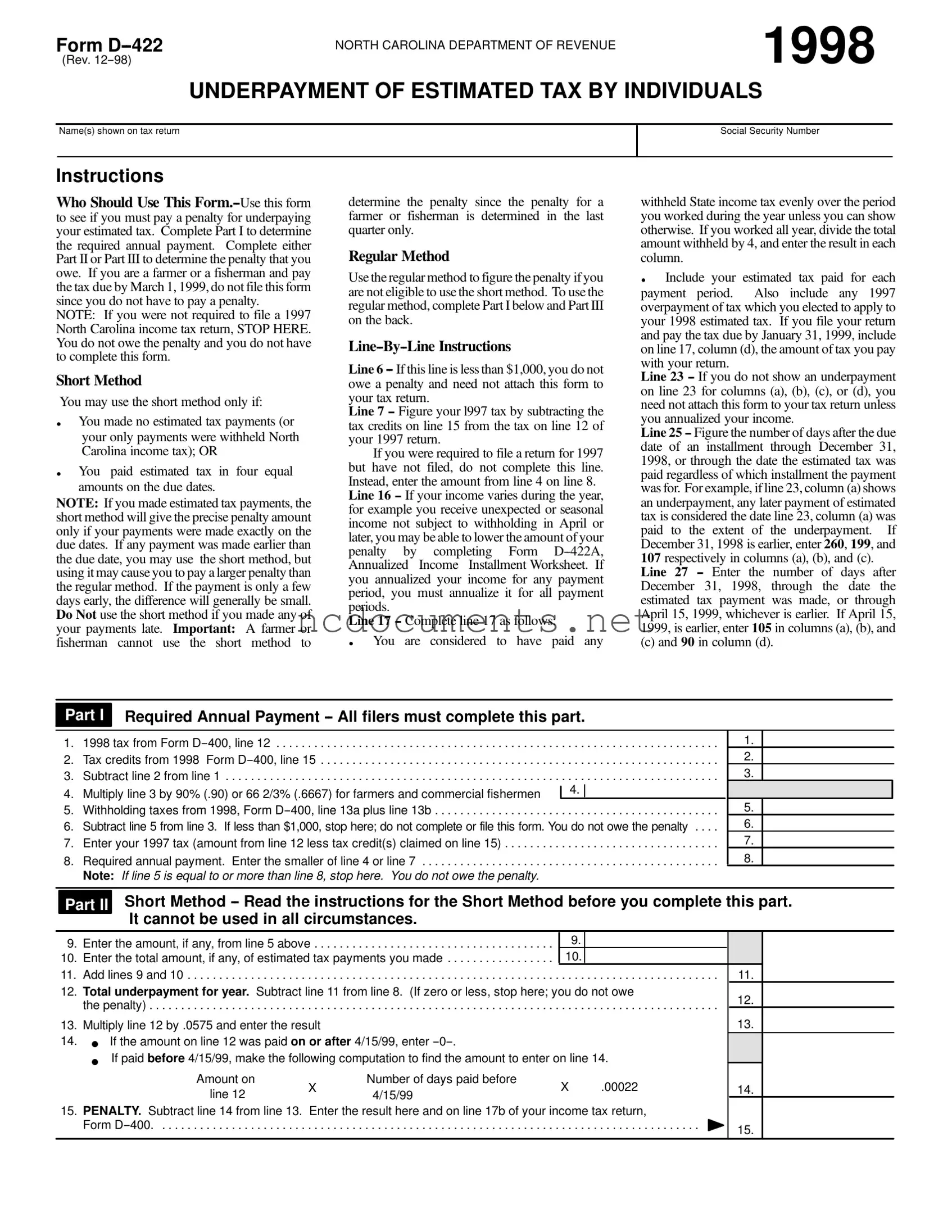

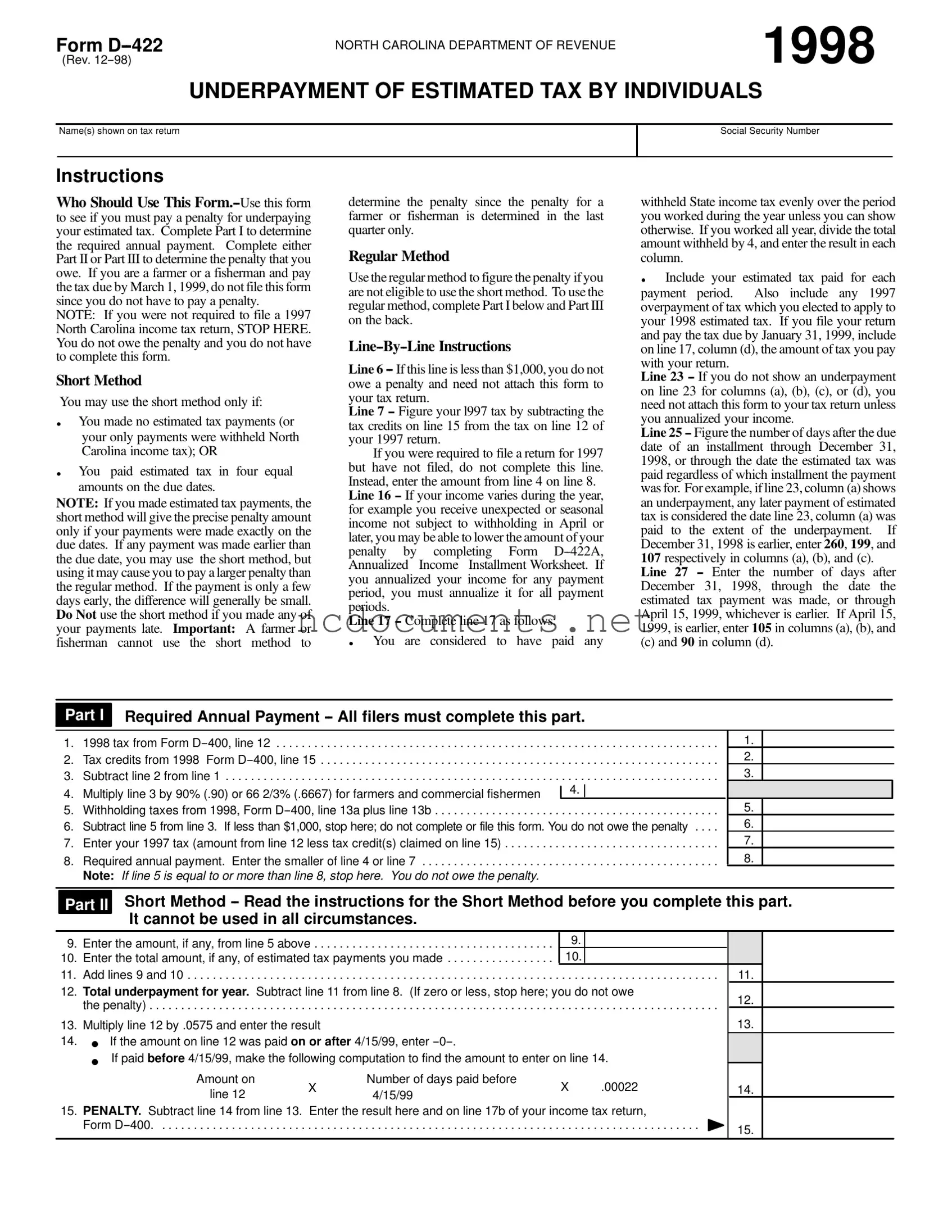

The D 422 North Carolina form, which addresses the underpayment of estimated tax by individuals, shares similarities with Form 1040-ES, the Estimated Tax for Individuals form used federally. Both forms serve to calculate whether taxpayers owe a penalty for underpayment of estimated taxes. While Form 1040-ES is used for federal tax purposes, D 422 focuses specifically on North Carolina state taxes. Each form requires individuals to assess their tax liabilities and compare them against the estimated payments made throughout the year. Furthermore, both forms include methods to calculate penalties based on the timing and amount of payments made, ensuring that taxpayers can accurately determine their obligations.

In Texas, ensuring proper documentation during the transfer of pet ownership is essential, and the Puppy Bill of Sale offers a straightforward solution to clarify the terms of the exchange, providing both parties with peace of mind regarding the transaction.

Another document akin to the D 422 is Form D-422A, the Annualized Income Installment Worksheet. This form is designed for individuals whose income fluctuates during the year, allowing them to adjust their estimated tax payments accordingly. Similar to the D 422, Form D-422A helps taxpayers determine if they owe a penalty for underpayment, but it does so by allowing for a more nuanced calculation based on annualized income rather than a flat estimate. This flexibility can significantly impact the penalty amount, making it a crucial tool for those with variable income streams.

Form 2210, the Underpayment of Estimated Tax by Individuals, is another related document. Used for federal tax purposes, this form helps taxpayers calculate penalties for not paying enough estimated tax throughout the year. Like the D 422, Form 2210 includes methods to compute the penalty based on the amount and timing of payments. Both forms require similar information about tax liabilities and payments made, highlighting the commonality in addressing underpayment issues at both state and federal levels.

Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, also bears resemblance to the D 422. While its primary purpose is to extend the deadline for filing tax returns, it indirectly relates to the concept of estimated tax payments. Taxpayers who file Form 4868 must still consider their estimated tax payments and potential penalties for underpayment, as failing to pay enough can lead to penalties regardless of an extension to file. Both forms emphasize the importance of meeting tax obligations, even when deadlines are adjusted.

Form NC-40, the North Carolina Individual Estimated Income Tax Payment Voucher, serves a similar function as the D 422 in that it deals with estimated tax payments. While the D 422 assesses penalties for underpayment, NC-40 is used to make the actual estimated tax payments. Both documents require taxpayers to calculate their expected tax liability and ensure that they are making sufficient payments throughout the year to avoid penalties. This connection underscores the importance of proactive tax management in both forms.

Lastly, Form 1099, specifically the 1099-MISC or 1099-NEC, is relevant when discussing estimated tax payments. These forms report various types of income, such as freelance or contract work, which may not have tax withheld. Taxpayers receiving income reported on these forms must consider their estimated tax obligations and potential penalties for underpayment, similar to the considerations outlined in the D 422. Both documents highlight the necessity for individuals to actively manage their tax responsibilities, especially when income is not subject to withholding.