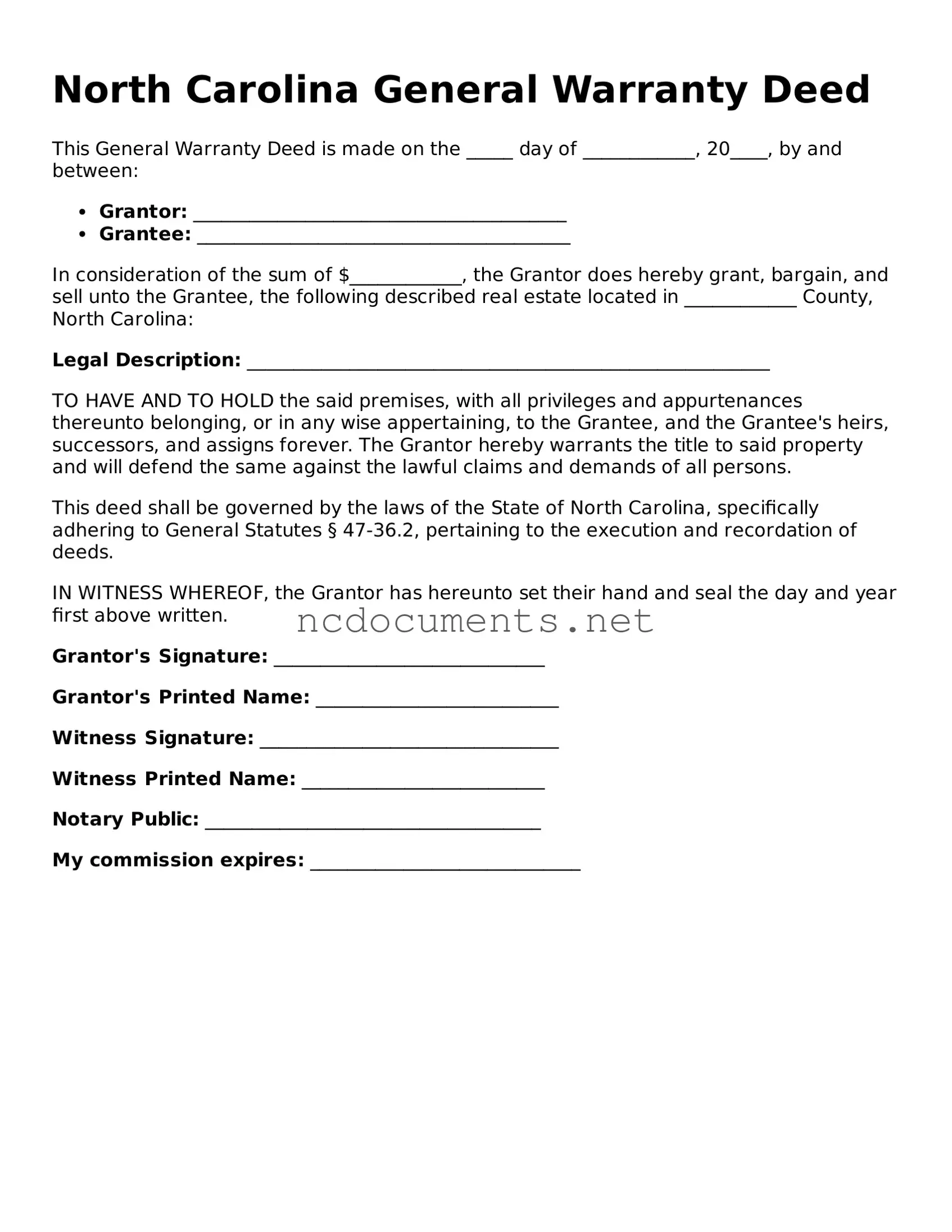

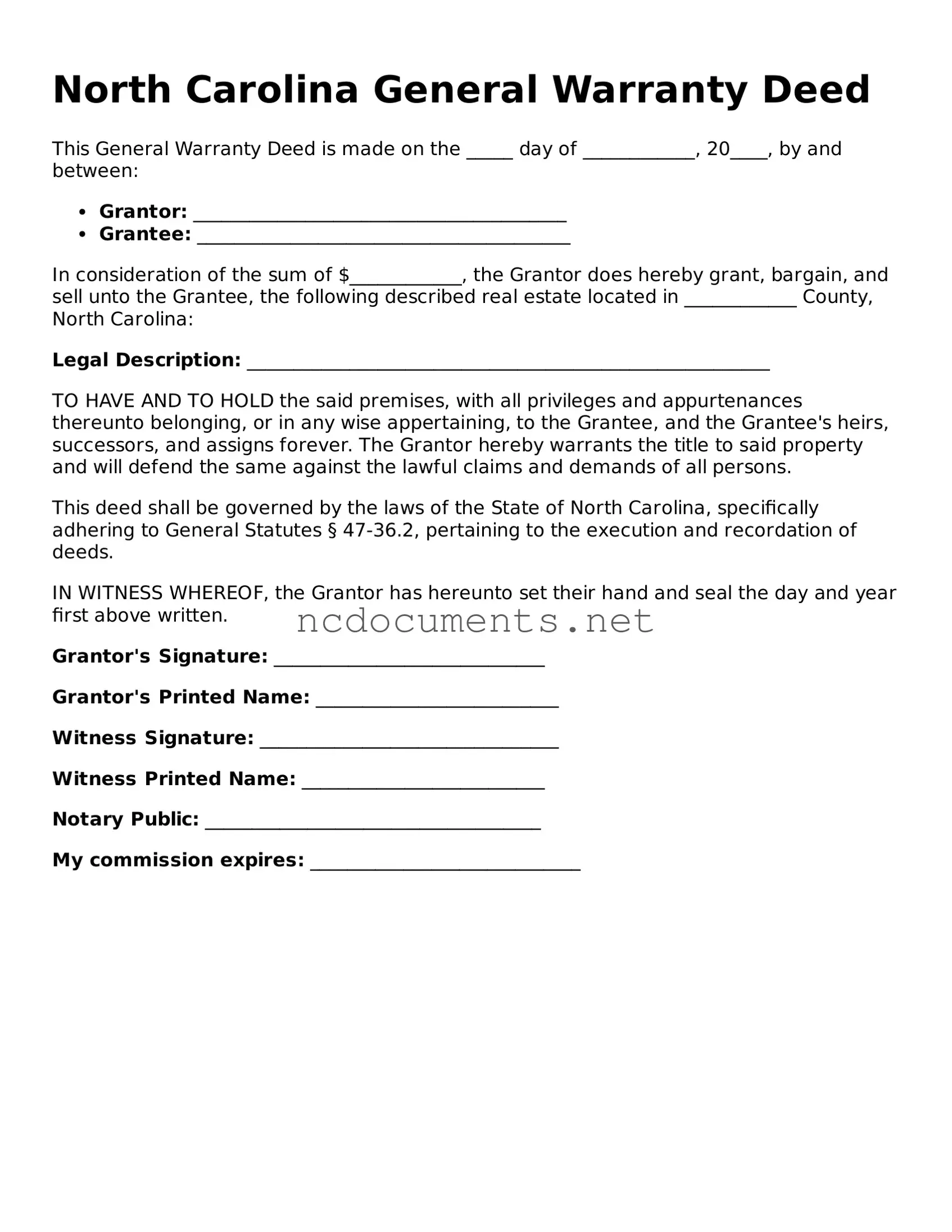

The North Carolina Deed form shares similarities with a Quitclaim Deed. Both documents transfer ownership of real property, but they do so in different ways. A Quitclaim Deed conveys whatever interest the grantor has in the property without guaranteeing that the title is clear. This means that the buyer assumes the risk regarding any potential claims against the property. In contrast, a North Carolina Deed may provide warranties or guarantees about the title, offering more protection to the buyer.

Another document similar to the North Carolina Deed is the Warranty Deed. Like the North Carolina Deed, a Warranty Deed assures the buyer that the seller holds clear title to the property and has the right to sell it. This type of deed includes covenants that protect the buyer against future claims. Both documents serve to formalize the transfer of property, but the Warranty Deed offers additional assurances about the state of the title.

The North Carolina Deed is also akin to a Special Warranty Deed. This type of deed provides limited warranties, only covering the time the seller owned the property. While both documents facilitate the transfer of ownership, a Special Warranty Deed does not guarantee that there were no issues with the title prior to the seller's ownership. Buyers should understand these differences to assess their level of risk.

When dealing with legal documents, understanding the purpose of a Notary Acknowledgement is vital. This form acts as a safeguard for transactions, confirming the identity of signers as they execute important papers. For more information, you can explore our guide on "understanding the Notary Acknowledgement process" at Notary Acknowledgement.

A Bill of Sale is another document that shares a purpose with the North Carolina Deed, although it typically pertains to personal property rather than real estate. A Bill of Sale transfers ownership of items like vehicles or equipment. While the North Carolina Deed focuses on land and buildings, both documents serve to legally transfer ownership from one party to another.

The North Carolina Deed can also be compared to a Lease Agreement. While a Lease Agreement does not transfer ownership, it grants a tenant the right to use and occupy property for a specified period. Both documents are crucial in real estate transactions, but they serve different functions. A Lease Agreement outlines the terms of use, while a Deed formalizes the ownership transfer.

An Affidavit of Title is similar in that it provides information about the ownership of a property. This document is often used in conjunction with a Deed to affirm that the seller has the right to sell the property. While the North Carolina Deed serves as the official record of transfer, the Affidavit can provide additional assurance to the buyer regarding the seller's ownership status.

A Power of Attorney can also relate to the North Carolina Deed, especially when someone is authorized to sign the Deed on behalf of another person. This legal document grants one individual the authority to act for another in legal matters. In property transactions, a Power of Attorney can facilitate the signing of a Deed when the property owner cannot be present.

Lastly, a Title Insurance Policy is not a deed but is closely related to the process of property transfer. This document protects the buyer from potential title issues that may arise after the purchase. While the North Carolina Deed serves to transfer ownership, Title Insurance provides peace of mind that the title is clear and free of disputes. Both documents play essential roles in ensuring a smooth real estate transaction.