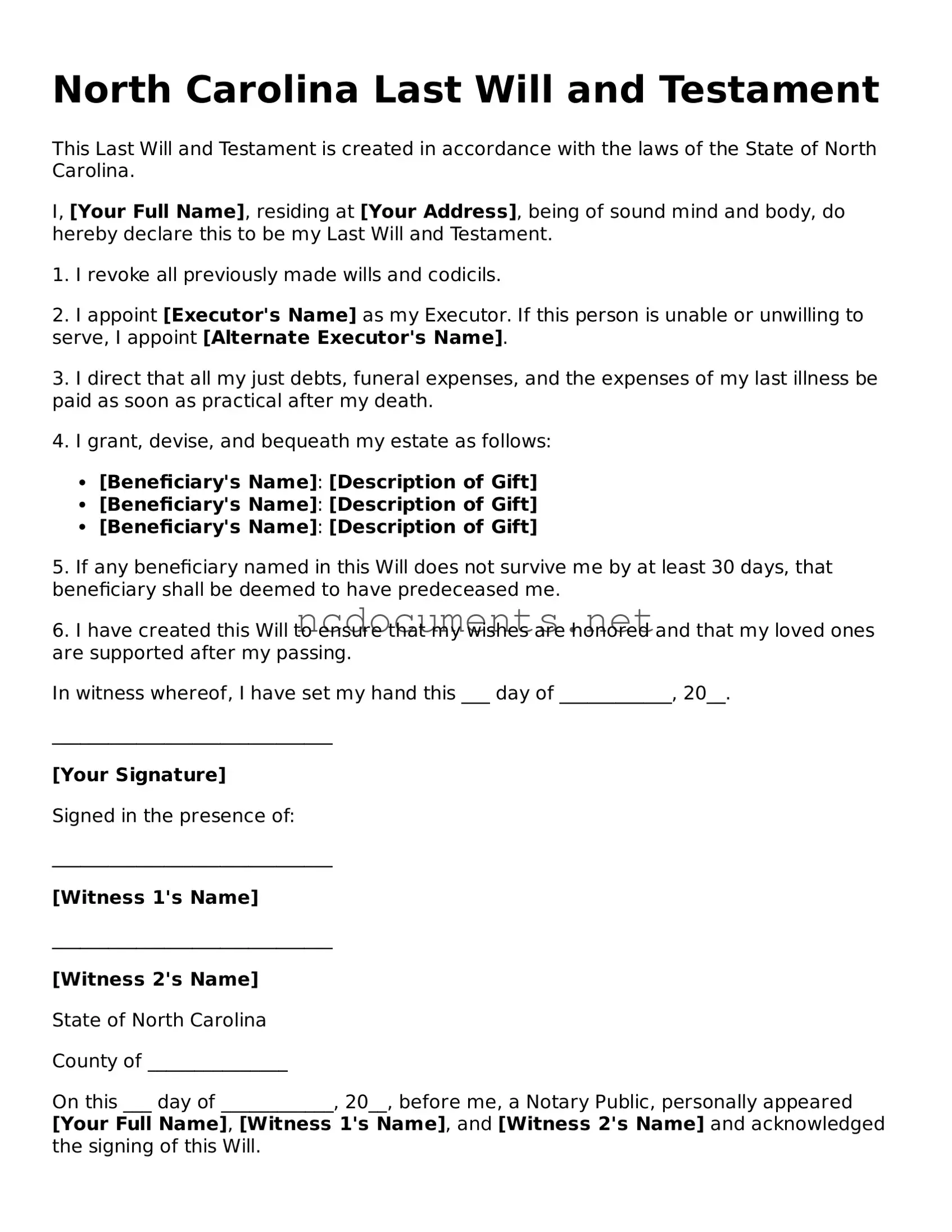

Filling out a Last Will and Testament form in North Carolina can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to sign the document. In North Carolina, your will must be signed by you or in your presence by another person at your direction. Without a signature, the will may not be considered valid.

Another mistake is not having the required witnesses. North Carolina law mandates that your will must be witnessed by at least two individuals who are at least 18 years old. If these witnesses are not present during the signing, or if they do not sign the will, it can create issues regarding its validity.

Many people also overlook the importance of clearly identifying their assets. When listing your belongings, be specific. Vague descriptions can lead to confusion and disputes among your heirs. For instance, instead of saying “my car,” specify the make, model, and year.

Some individuals forget to update their will after major life events, such as marriage, divorce, or the birth of a child. Failing to revise your will can result in unintended beneficiaries or outdated instructions. It’s essential to review and update your will regularly to reflect your current situation.

Another common error is not including a residuary clause. This clause addresses what happens to any assets not specifically mentioned in the will. Without it, those assets may be distributed according to state law rather than your wishes, which can be frustrating for your loved ones.

People sometimes fail to consider their digital assets. In today’s world, online accounts and digital properties hold significant value. Make sure to include instructions on how to handle these assets, whether it’s social media accounts, online banking, or digital files.

Additionally, some individuals may not understand the implications of choosing the wrong executor. This person will be responsible for carrying out your wishes as outlined in the will. Choose someone trustworthy and capable, as this role comes with significant responsibilities.

Another mistake is being too informal in language. While it’s important to express your wishes clearly, avoid using casual language that might not be legally binding. Stick to clear, concise, and formal wording to ensure your intentions are understood.

Many people also neglect to consider tax implications. Depending on the size of your estate, taxes may need to be addressed in your will. It’s wise to consult with a financial advisor or attorney to understand how to minimize potential tax burdens on your heirs.

Finally, don’t forget to store your will in a safe yet accessible place. If your loved ones can’t find it when the time comes, your wishes may not be honored. Consider keeping a copy with your attorney and letting your executor know where to find the original.