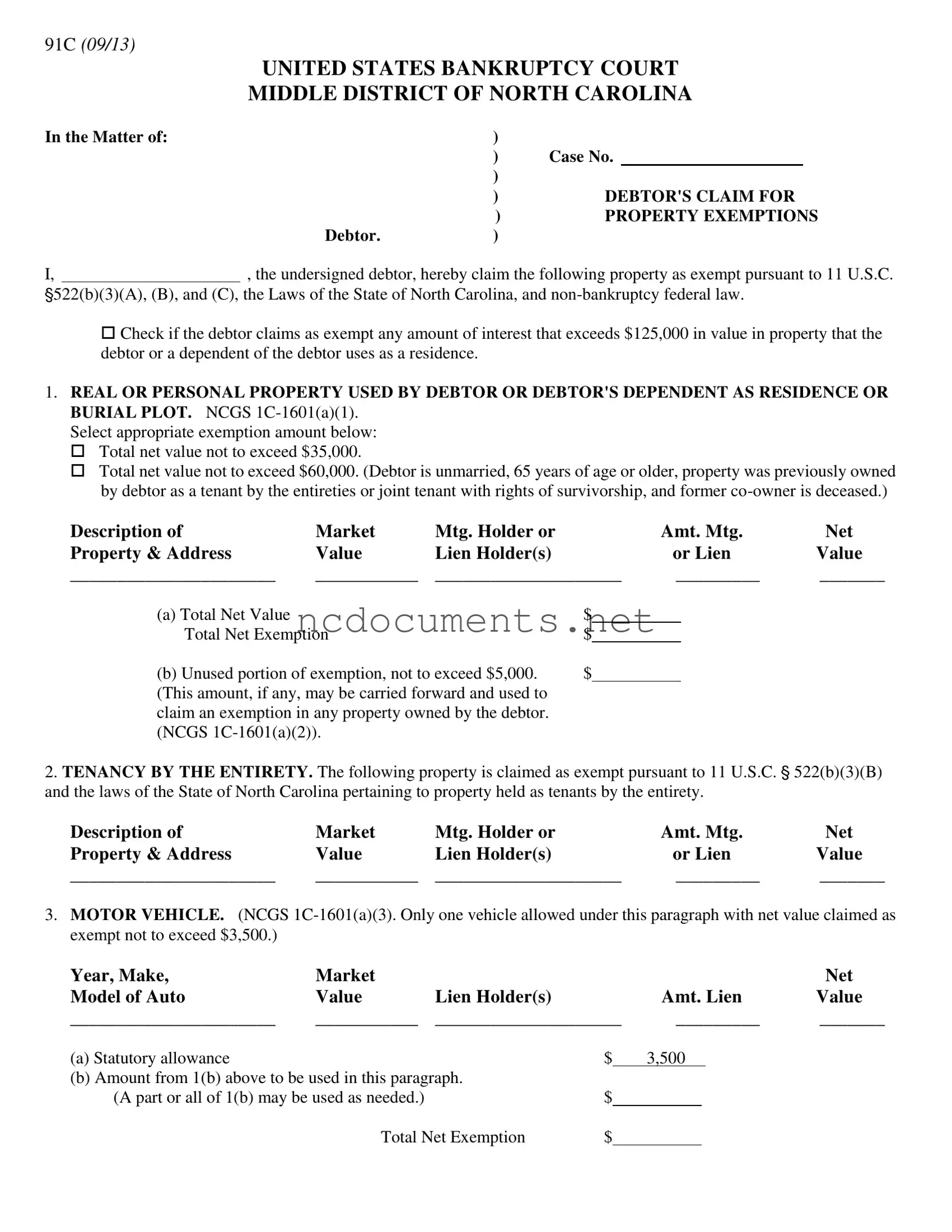

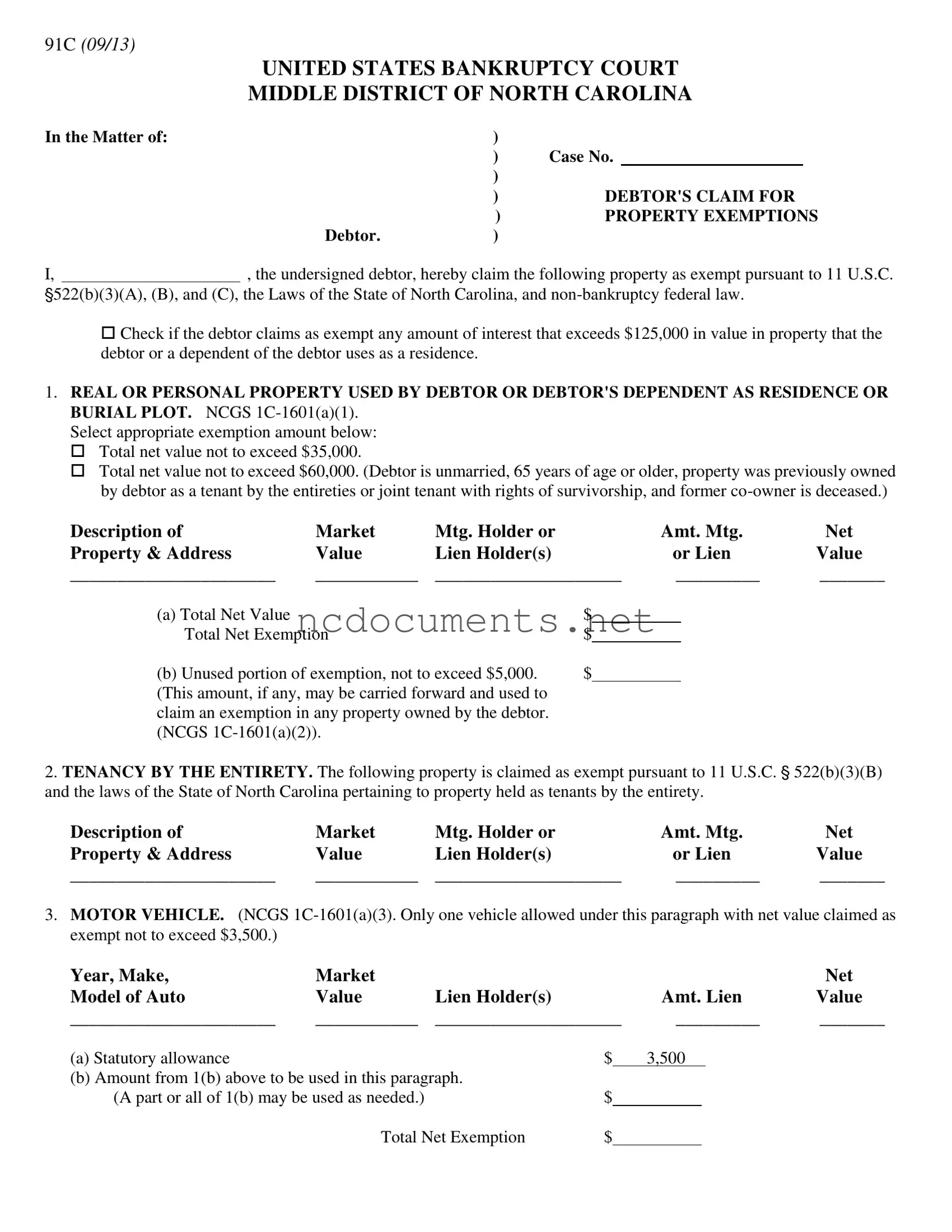

The North Carolina 91C form shares similarities with the Federal Bankruptcy Form 106C, which is used for claiming exemptions in personal bankruptcy cases. Both forms allow debtors to list property they wish to protect from creditors. The Federal form outlines specific categories of exemptions, such as household goods, motor vehicles, and tools of the trade, mirroring the structure found in the North Carolina 91C form. Each form requires the debtor to provide details about the property, including its value and any liens, ensuring that the debtor's claims for exemptions are clearly documented.

Another similar document is the California Schedule C, which is part of the bankruptcy filing process in California. Like the North Carolina 91C form, Schedule C allows debtors to claim exemptions for their property under state and federal law. Both documents require a detailed description of the property and its value, facilitating the protection of essential assets during bankruptcy proceedings. The California Schedule C also includes specific exemptions tailored to state law, similar to the exemptions outlined in the North Carolina form.

The Texas Homestead Exemption Application serves a similar purpose, focusing on the protection of a debtor's primary residence. This document allows Texas residents to claim a homestead exemption, which can shield a significant portion of their home equity from creditors. Both the Texas application and the North Carolina 91C form require the debtor to provide information about the property and its value. However, the Texas form is more specific to real property, while the 91C encompasses a broader range of personal and real property exemptions.

The Florida Exemption Claim Form is another comparable document. It allows Florida debtors to assert exemptions for various types of property, including homestead, personal property, and retirement accounts. Similar to the North Carolina 91C, this form requires debtors to list property, its value, and any encumbrances. Both forms aim to protect essential assets from liquidation during bankruptcy, reflecting the importance of preserving a debtor's quality of life.

The New York Schedule C is also akin to the North Carolina 91C form, as it outlines exemptions for personal property in bankruptcy cases. Debtors in New York can claim exemptions for their household items, vehicles, and other essential assets. Both forms require a detailed inventory of the claimed property, emphasizing the need for transparency in the exemption process. This similarity underscores the shared goal of protecting debtors from losing critical personal belongings during financial distress.

The Illinois Exemption Claim Form presents another parallel. This document allows Illinois debtors to claim exemptions on their property, including personal items and real estate. Like the North Carolina 91C form, it requires detailed descriptions and values of the claimed property. Both forms serve to safeguard the debtor’s essential assets from creditors, highlighting the legal framework that supports financial rehabilitation.

In the realm of pet ownership, it's crucial to understand the importance of the Puppy Bill of Sale, a legal document that facilitates the transfer of a dog from one owner to another in Texas, safeguarding the rights of both parties involved.

The Ohio Schedule C is similar in that it allows debtors to list exemptions for personal property, including vehicles and household items. This form, like the North Carolina 91C, provides categories for different types of exemptions and requires the debtor to provide details about each item. Both documents aim to protect the debtor's basic needs during bankruptcy proceedings, ensuring a smoother transition towards financial recovery.

The Virginia Bankruptcy Exemption Form is another document that parallels the North Carolina 91C form. This form allows Virginia debtors to claim exemptions on personal property and real estate. Both documents require a thorough listing of claimed property, including its value and any liens. The focus on preserving essential assets is a common theme, as both forms seek to provide debtors with a fresh start while protecting their fundamental rights.

Lastly, the Georgia Exemption Claim Form serves a similar function. It enables Georgia debtors to claim exemptions for personal and real property, requiring detailed descriptions and valuations. Like the North Carolina 91C, this form is designed to protect debtors from losing critical assets during bankruptcy. Both forms reflect the legal protections available to individuals facing financial difficulties, emphasizing the importance of maintaining a basic standard of living.