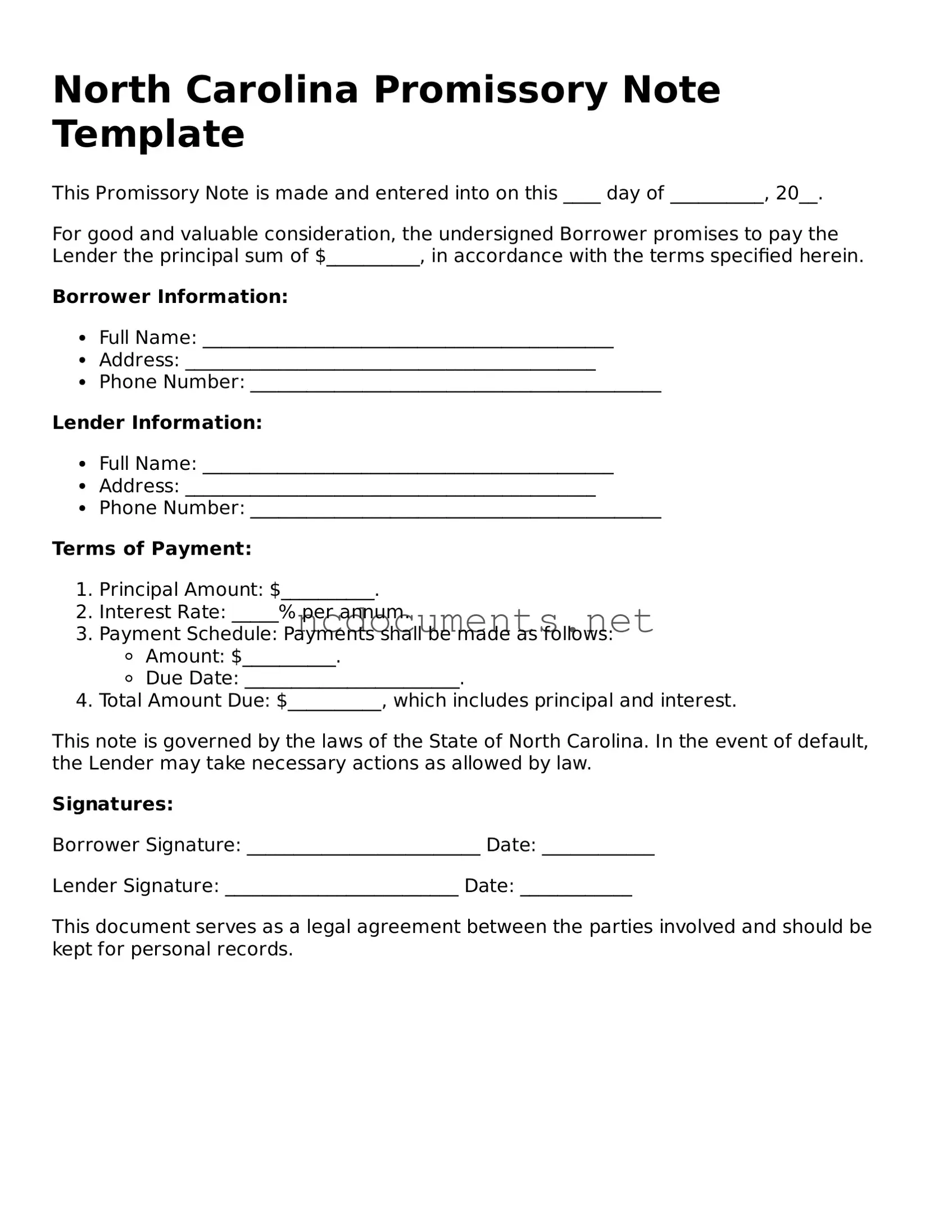

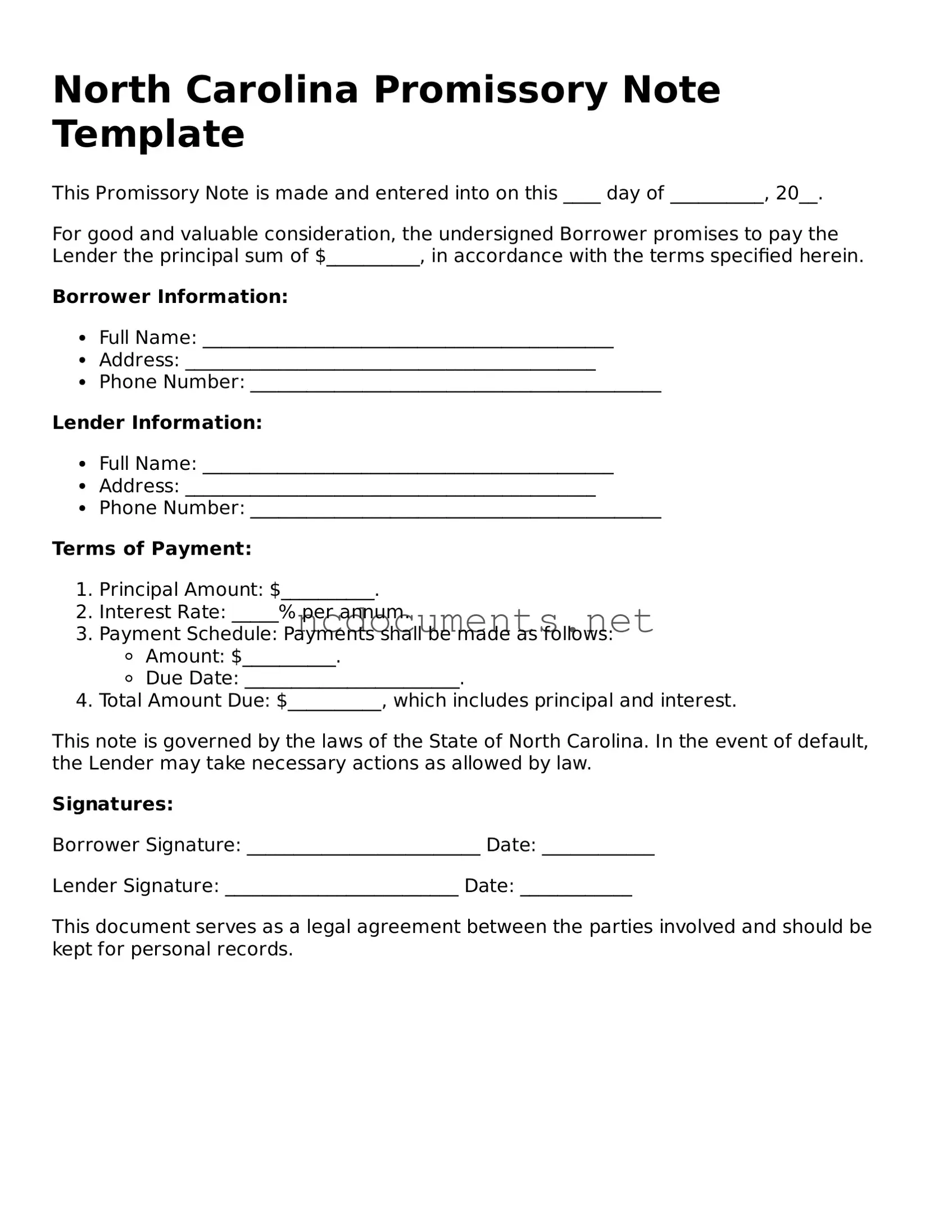

The North Carolina Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan between a borrower and a lender. They specify the principal amount, interest rate, repayment schedule, and consequences of default. While a promissory note is often simpler and focuses primarily on the borrower's promise to repay, a loan agreement may include additional clauses, such as covenants and representations, providing more comprehensive terms for the transaction.

A Secured Promissory Note is another document akin to the North Carolina Promissory Note. This version includes collateral to secure the loan, which provides the lender with a claim to the specified asset if the borrower defaults. Like the standard promissory note, it details the repayment terms, but the inclusion of collateral adds a layer of security for the lender, making it a more robust option for high-risk loans.

When purchasing an ATV in Colorado, it's crucial to have the correct documentation to ensure a seamless transfer of ownership. The Colorado ATV Bill of Sale form serves this purpose by providing a transparent record of the transaction. For more detailed information on how to obtain and fill out this essential document, you can visit All Colorado Documents, which offers a convenient resource for buyers and sellers alike.

An Installment Loan Agreement is also similar. This document outlines a loan that is repaid in regular installments over a set period. Both the Installment Loan Agreement and the North Carolina Promissory Note detail the amount borrowed and the payment schedule. However, the Installment Loan Agreement often includes more specifics about the payment process and any fees associated with late payments, making it more detailed than a standard promissory note.

A Personal Loan Agreement is comparable as well. It serves as a contract between individuals, detailing the terms of a personal loan. Similar to the North Carolina Promissory Note, it specifies the loan amount, interest rate, and repayment terms. However, a Personal Loan Agreement may also include conditions regarding the use of funds and requirements for borrower disclosures, which are not typically found in a standard promissory note.

The Mortgage Note is another document that bears resemblance to the North Carolina Promissory Note. This note is used in real estate transactions and serves as a written promise to repay a loan secured by real property. Both documents outline the borrower's commitment to repay, but the Mortgage Note is tied to a specific property and includes terms related to foreclosure and property rights, adding complexity to the agreement.

A Car Loan Agreement shares similarities with the North Carolina Promissory Note as well. This document outlines the terms of financing for a vehicle purchase. Like the promissory note, it specifies the amount financed, interest rate, and repayment terms. However, a Car Loan Agreement may also include additional details about the vehicle, warranties, and responsibilities of both parties, which are not typically included in a standard promissory note.

A Business Loan Agreement is also comparable. This document is used when a business borrows funds and includes terms similar to those found in the North Carolina Promissory Note. It outlines the loan amount, interest rate, and repayment schedule. However, it often includes specific conditions related to the business's operations and financial performance, which are generally absent from personal promissory notes.

The Student Loan Agreement is another document that aligns with the North Carolina Promissory Note. This agreement outlines the terms under which a student borrows money to pay for education expenses. Both documents specify the loan amount, interest rate, and repayment terms. However, the Student Loan Agreement often includes provisions related to deferment, grace periods, and forgiveness options, reflecting the unique nature of educational financing.

A Credit Card Agreement is also similar in nature. This document outlines the terms of borrowing through a credit card, including the credit limit, interest rates, and repayment obligations. While a credit card agreement functions differently than a promissory note, both documents require the borrower to repay borrowed funds under specified terms. The Credit Card Agreement typically includes more detailed information about fees and penalties, which are less common in a standard promissory note.

Lastly, a Lease Agreement can be compared to the North Carolina Promissory Note. While primarily used for renting property, a Lease Agreement may include a provision for a security deposit or advance rent, similar to the collateral aspect of a secured promissory note. Both documents establish a financial obligation, although the Lease Agreement focuses on the rental terms and conditions rather than a direct loan.