What is a Quitclaim Deed in North Carolina?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In North Carolina, this type of deed allows the grantor, or seller, to relinquish any claim to the property without making any guarantees about the title. This means that the grantor does not promise that they own the property free and clear of any liens or other claims. It is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in several situations, including:

-

Transferring property between family members, such as parents to children.

-

Clearing up title issues, such as when a spouse is removed from a property title after a divorce.

-

Transferring property into a trust.

-

Correcting a title mistake or misspelling.

However, it is important to note that using a Quitclaim Deed does not guarantee that the property is free from debts or claims.

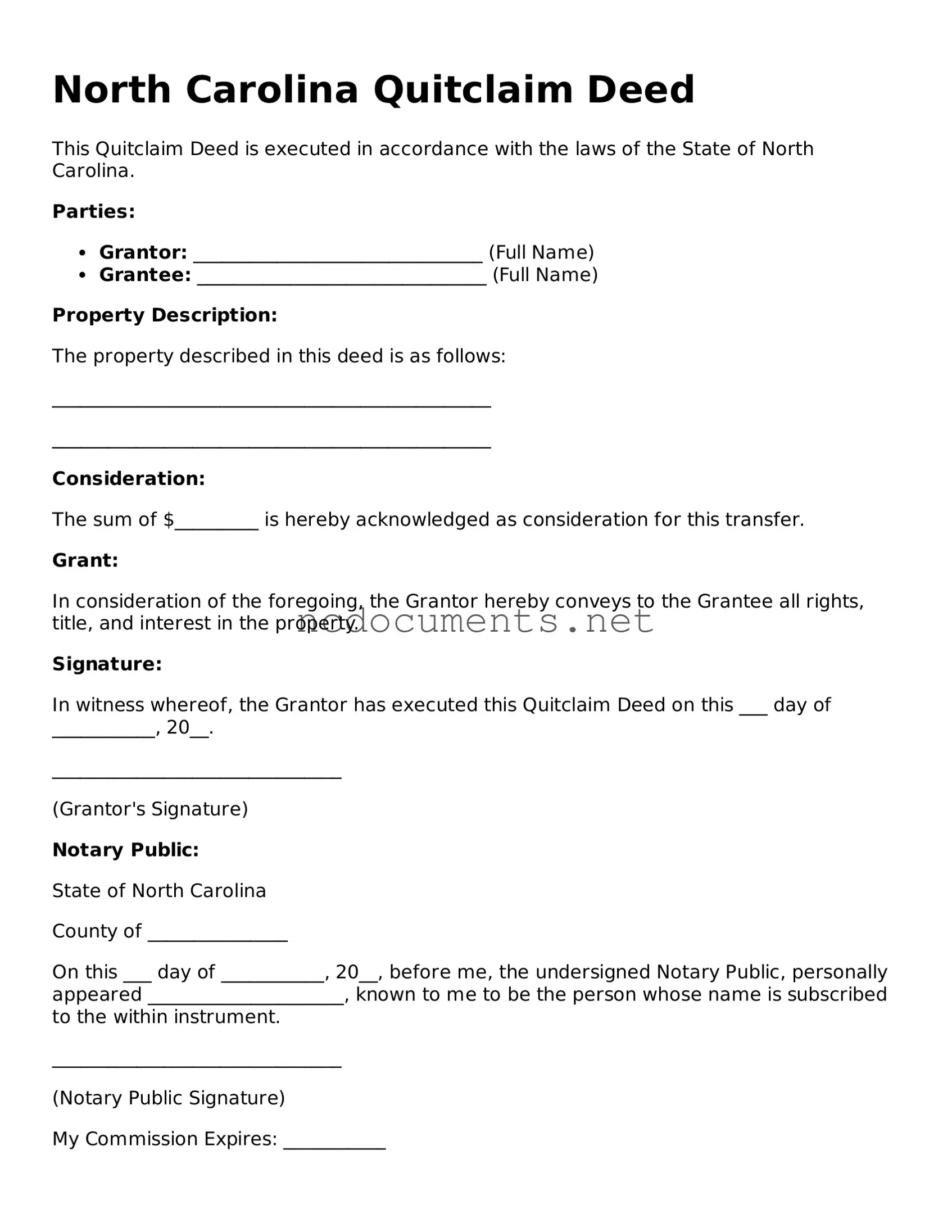

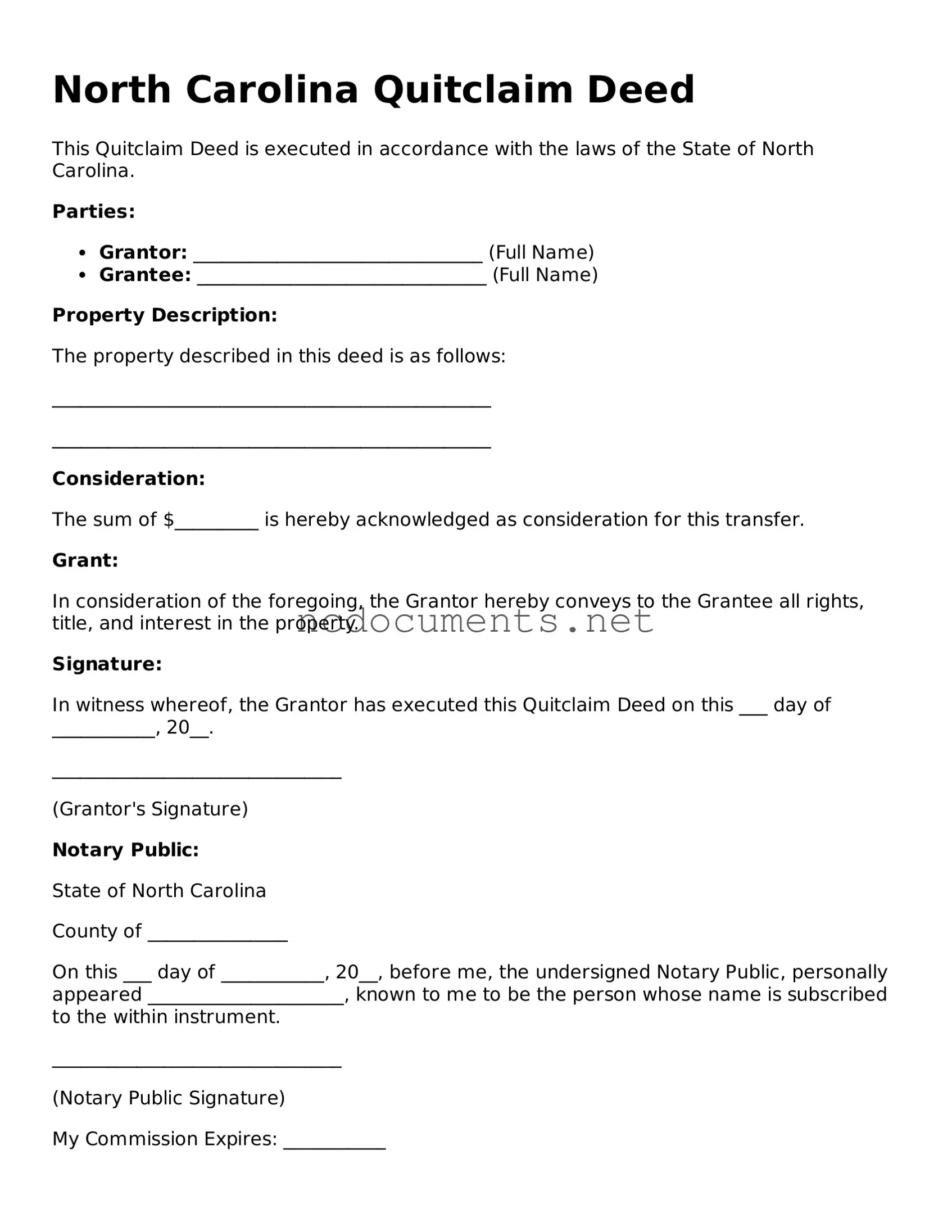

How do I complete a Quitclaim Deed in North Carolina?

Completing a Quitclaim Deed involves several steps:

-

Obtain the Quitclaim Deed form. You can find templates online or at legal stationery stores.

-

Fill out the form with the necessary information, including the names of the grantor and grantee, a description of the property, and the date of transfer.

-

Have the deed signed by the grantor in the presence of a notary public.

-

Record the completed deed with the county register of deeds where the property is located. This step is crucial to make the transfer official.

Are there any fees associated with a Quitclaim Deed?

Yes, there are fees associated with a Quitclaim Deed in North Carolina. While the cost of obtaining the form itself is usually minimal, you will need to pay a recording fee when you submit the deed to the county register of deeds. This fee can vary by county, so it is a good idea to check with your local office for the exact amount. Additionally, if you choose to have a lawyer assist you, there may be legal fees involved.

Does a Quitclaim Deed affect property taxes?

A Quitclaim Deed itself does not directly affect property taxes. However, transferring ownership of the property may trigger a reassessment by the local tax authority. This could lead to changes in the assessed value of the property and, consequently, the property taxes owed. It’s wise to consult with a local tax professional to understand how the transfer may impact your specific situation.

Can a Quitclaim Deed be reversed?

Generally, a Quitclaim Deed is a final transfer of ownership. Once the deed is recorded, the transfer cannot be easily reversed. If the parties involved wish to undo the transfer, they would typically need to create a new legal document, such as a new deed, to transfer the property back to the original owner. This process can be complex, especially if there are disputes or if the property has changed hands multiple times.