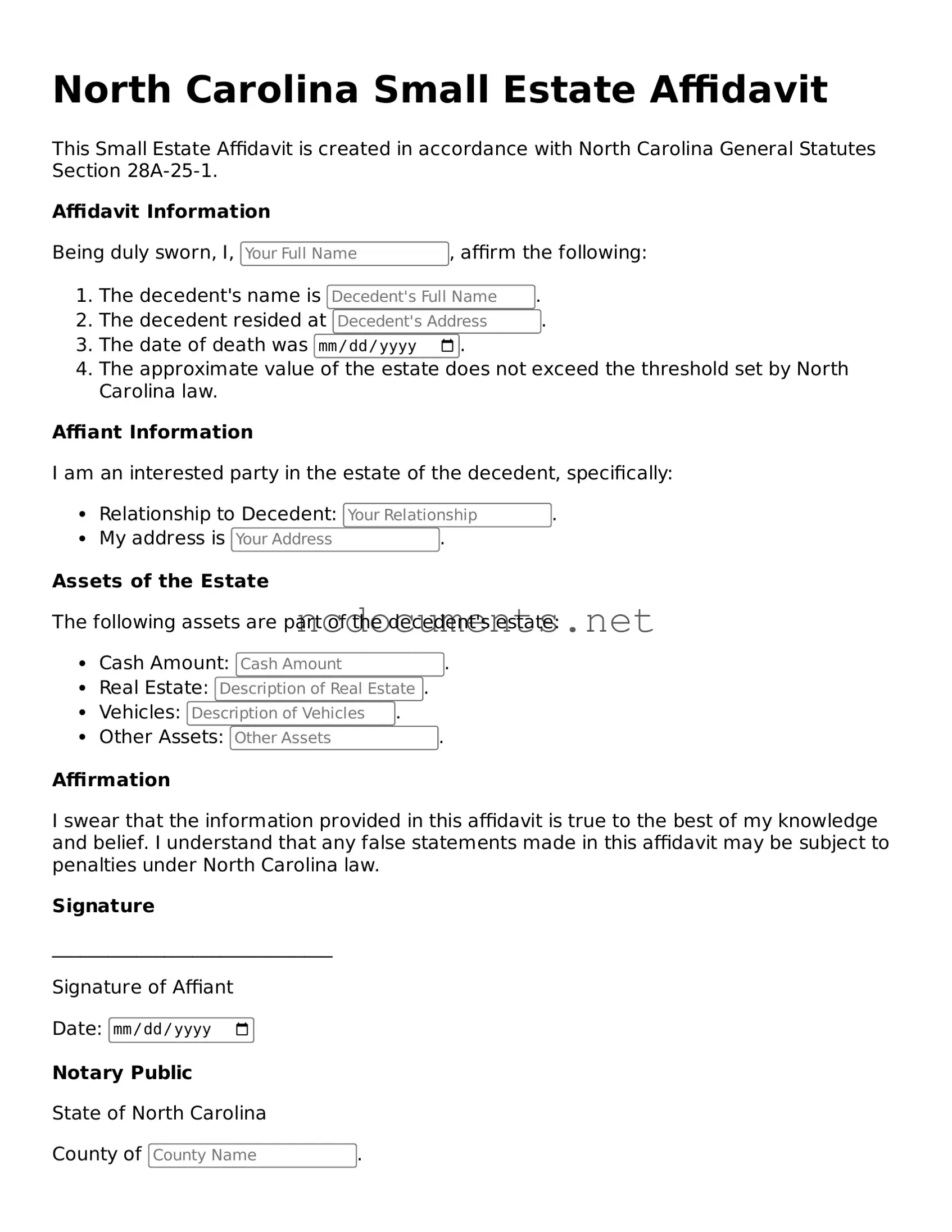

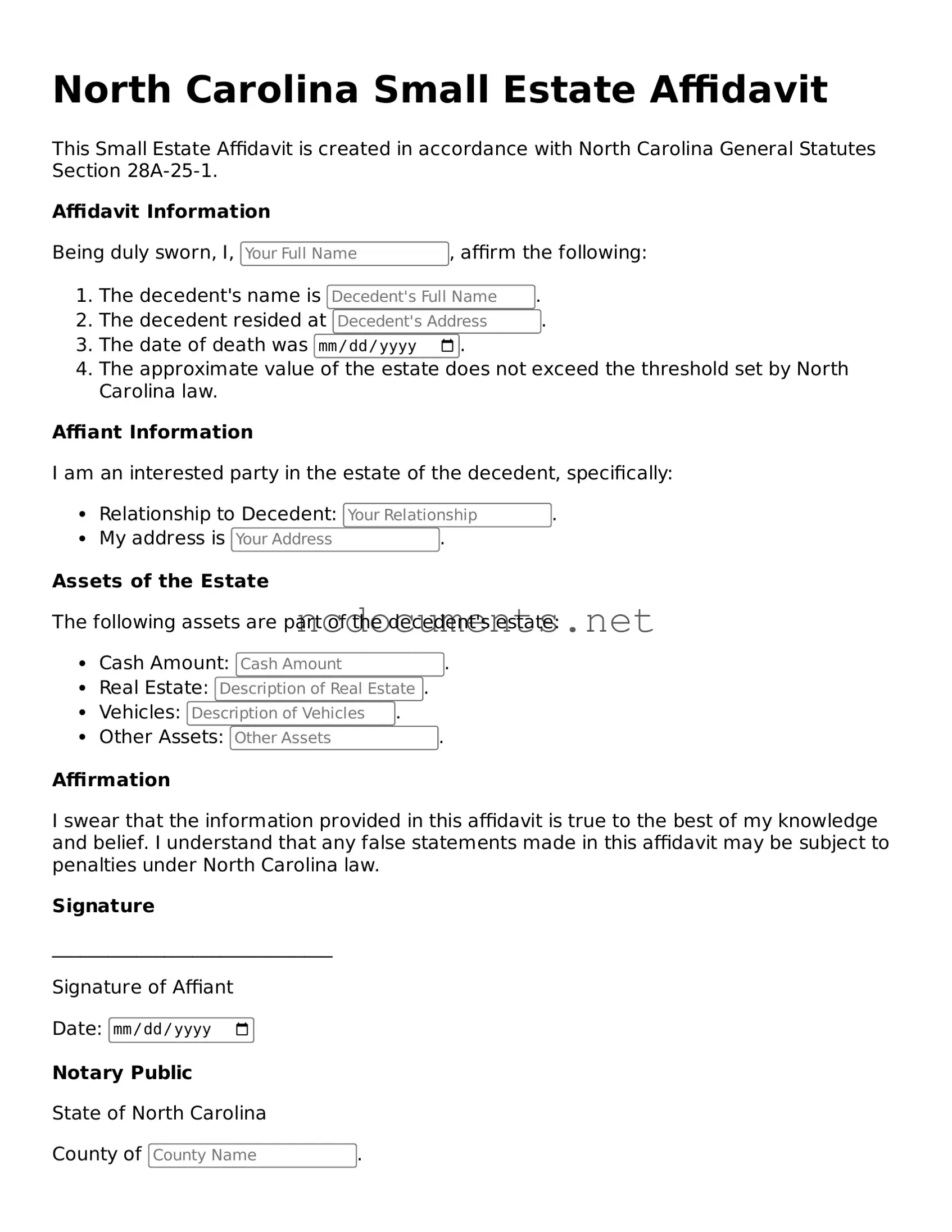

The North Carolina Small Estate Affidavit is a legal document used to simplify the process of settling small estates. It allows heirs to claim property without going through the full probate process, making it efficient for estates that meet certain value thresholds. Similar to this document is the Affidavit of Heirship, which is often used in various states. This affidavit establishes the identity of heirs when someone dies without a will. It can help heirs claim property by confirming their relationship to the deceased, thus streamlining the transfer of assets.

Another document that shares similarities with the Small Estate Affidavit is the Letter of Administration. This letter is issued by a probate court when someone dies intestate, meaning without a will. It grants the administrator the authority to manage the deceased's estate. While the Small Estate Affidavit is used for smaller estates, the Letter of Administration applies to larger ones, requiring more formal court involvement.

The Will is also comparable to the Small Estate Affidavit. A will outlines how a person's assets should be distributed after death. While a will requires probate, which can be lengthy, the Small Estate Affidavit provides a quicker alternative for small estates. Both documents reflect the deceased's intentions, but the Small Estate Affidavit bypasses some legal formalities.

The Durable Power of Attorney (DPOA) is another related document. While not specifically for posthumous asset distribution, a DPOA allows an individual to designate someone to manage their affairs while they are still alive. This can help avoid complications later on, as it ensures that someone trusted can handle financial matters without needing to go through probate or a Small Estate Affidavit.

In addition to the various estate planning documents discussed, understanding the importance of liability waivers is crucial for those involved in any events or activities. One such document is the Hold Harmless Agreement, tailored to protect parties from legal claims arising from unforeseen circumstances. For more information on how to create this essential agreement, one can refer to floridadocuments.net/fillable-hold-harmless-agreement-form, which provides a fillable format to ensure clarity and protection for all involved.

The Trust is a document that can also serve a similar purpose. A trust allows for the management and distribution of assets without going through probate. When properly established, a trust can help avoid the need for a Small Estate Affidavit altogether. It provides a way to transfer property directly to beneficiaries upon death, ensuring a smoother transition of assets.

The Affidavit of Collection of Personal Property is another document that functions similarly to the Small Estate Affidavit. This affidavit allows heirs to collect personal property without formal probate proceedings. It is typically used when the estate consists solely of personal property and falls under the value threshold, thus simplifying the process for heirs.

The Summary Administration form, used in some states, is another comparable document. This form allows for a simplified probate process for smaller estates. It provides a quicker resolution for distributing assets without the full probate process, similar to the function of the Small Estate Affidavit in North Carolina.

Finally, the Petition for Letters Testamentary is relevant in this context. This document is filed to initiate the probate process when a will exists. It grants the executor authority to manage the estate. Although it is more formal than the Small Estate Affidavit, both documents aim to facilitate the transfer of assets, albeit through different legal pathways.