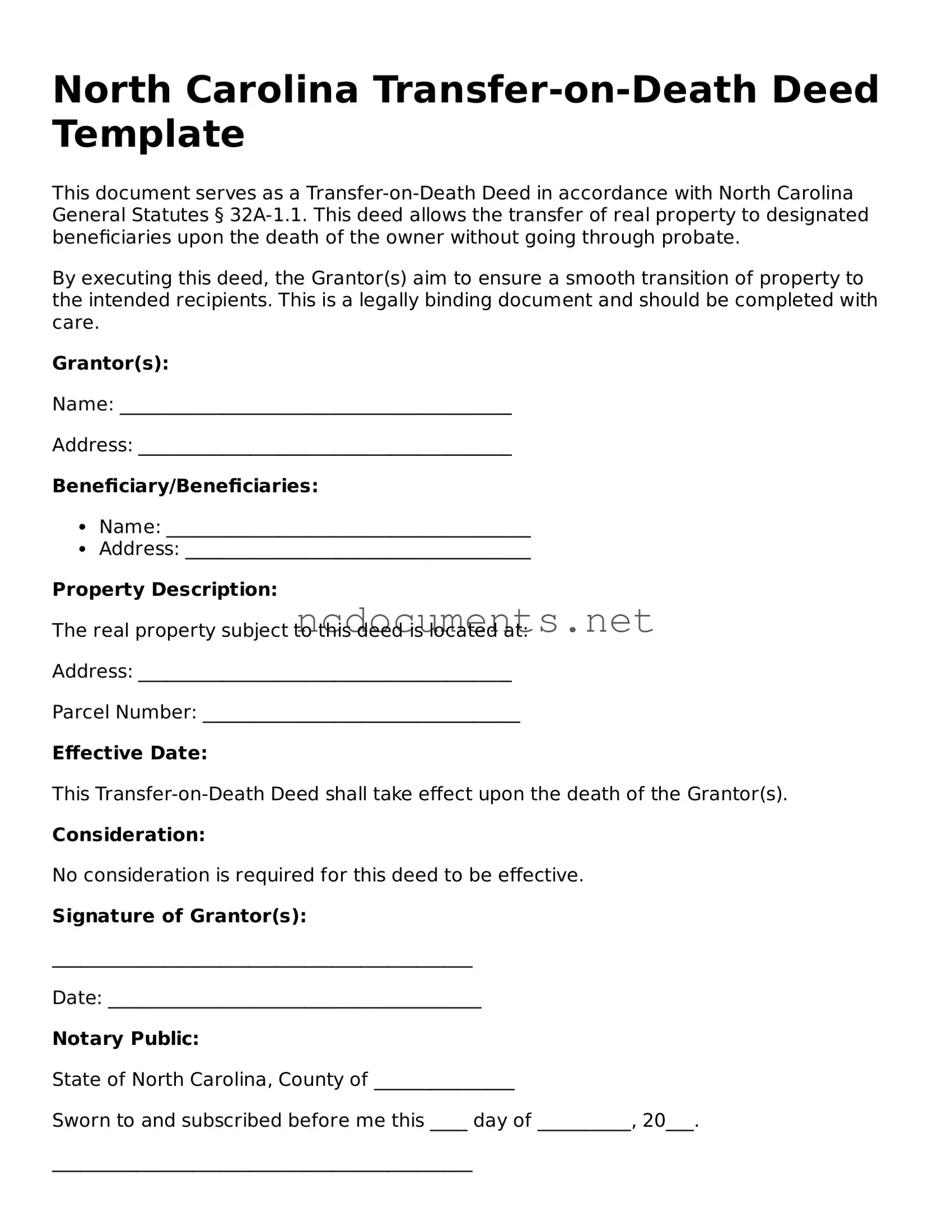

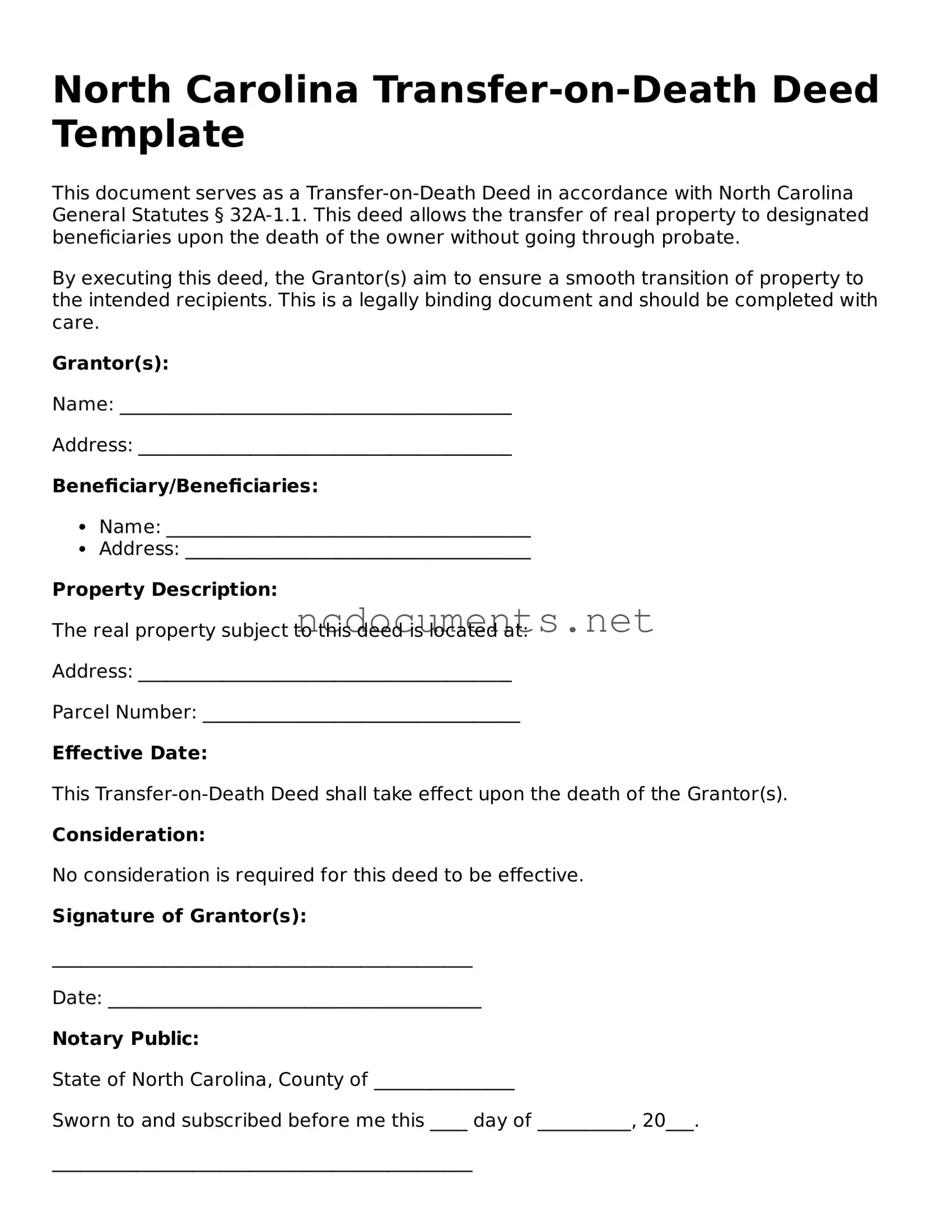

Filling out a Transfer-on-Death Deed form in North Carolina can seem straightforward, but there are several common mistakes that individuals often make. One frequent error is failing to include the legal description of the property. This description is crucial as it identifies the specific piece of real estate being transferred. Without it, the deed may be deemed invalid.

Another mistake involves not signing the deed properly. All required parties must sign the document, and their signatures must be notarized. A deed that lacks proper signatures or notarization can lead to complications and may not be recognized by the state.

People often overlook the importance of naming the beneficiaries clearly. Using vague terms or nicknames can create confusion and disputes later on. It’s essential to use full legal names and, if possible, include their relationship to the grantor to avoid ambiguity.

Additionally, some individuals forget to review the deed for accuracy before submitting it. Typos or incorrect information can lead to delays or rejections. Taking the time to double-check the details can save significant headaches down the line.

Another common pitfall is not understanding the implications of the Transfer-on-Death Deed. Some people mistakenly believe that this deed can be used for all types of property or that it bypasses all estate taxes. In reality, while it allows for a smooth transfer of property upon death, other financial considerations may still apply.

Not recording the deed with the appropriate county office is another mistake that can undermine the effectiveness of the Transfer-on-Death Deed. Even if the deed is filled out correctly, failing to file it means that the transfer will not be legally recognized, and the property may still go through probate.

Moreover, individuals sometimes neglect to inform their beneficiaries about the existence of the deed. This lack of communication can lead to confusion and disputes among family members after the grantor's death. Ensuring that beneficiaries are aware can facilitate a smoother transition.

Some people also make the error of thinking they can change the beneficiaries after the deed has been recorded without following the proper procedures. In North Carolina, any changes must be made through a new deed or a formal revocation of the original deed.

Lastly, individuals often fail to seek legal advice when completing a Transfer-on-Death Deed. Consulting with a legal professional can help navigate the complexities of property law and ensure that all steps are taken correctly. Skipping this step can lead to costly mistakes that could have been avoided.